Overview:

San Jose’s multifamily market demonstrated sustained strength throughout 2025, anchored by robust rent growth and a clear rebound in investment activity. Even amid broader economic uncertainty, the market consistently outperformed national trends, reinforcing its position as one of the Bay Area’s most durable rental markets.

According to fourth quarter 2025 data from CoStar, average asking rents in San Jose climbed to $3,190 per month, representing 3.2 percent year over year growth. That pace places San Jose among the strongest performing large multifamily markets in the country and well ahead of the national average rent increase of approximately 1.8 percent. The ability to sustain above average rent growth at an already elevated price point underscores the depth of demand supported by Silicon Valley’s high incomes and concentrated employment base.

This operating strength has been matched by renewed investor conviction. Year to date multifamily sales volume reached $2.1 billion in 2025, leading the Bay Area in dollar volume. Institutional and REIT investors accounted for the majority of activity, targeting high quality well located assets. Major transactions including the $370 million sale of Park Kiely and the $143.5 million trade of 1250 Lakeside highlight a clear preference for Class A communities in transit oriented Silicon Valley submarkets.

Supply dynamics continue to favor landlords. With only 2,427 units under construction representing approximately 1.5 percent of existing inventory, new supply remains constrained and supports pricing power. Deliveries were absorbed efficiently throughout the year, keeping vacancy below 5 percent and reinforcing the market’s ability to support continued rent appreciation.

Affordability pressures further amplify rental demand. Median household income in San Jose increased roughly 5 percent in 2025 to $170,000, supporting renters’ capacity to absorb higher rents even as homeownership remains out of reach for many. Demand is also being reinforced by employers increasing in office requirements and continued hiring tied to artificial intelligence and advanced technology sectors.

Looking ahead, San Jose is expected to remain a national leader in rent growth. According to Apartments.com and CoStar forecasts, San Jose is projected to post approximately 4.3 percent rent growth in 2026, the highest among major US metros. That outlook compares favorably to the national average, which is expected to rise modestly to about 1.9 percent as markets continue to absorb elevated supply levels. San Jose’s constrained pipeline, limited new deliveries estimated at roughly 600 market rate units over the next 12 months, and strong demand drivers position the market to outperform even as rent growth accelerates unevenly across the country.

Taken together, the combination of above average rent growth in 2025, a leading national outlook for 2026, constrained supply, and renewed institutional investment reinforces San Jose’s long term multifamily fundamentals and underscores the continued need for additional housing to meet demand across Silicon Valley.

-

San Jose’s rents reached $3,190/month in Q4 2025, up 3.2% year over year, compared with the U.S. average of $1,756/month and national rent growth of 1.8%. Vacancy in San Jose tightened to 4.8%, well below the national 8.4% average.

-

Limited new construction in San Jose (only 2,427 units underway) and strong local fundamentals are sustaining demand even as many other markets see slower growth.

-

Read the full article here

-

CoStar’s September rent data highlights San Jose as one of the most expensive rental markets in the United States, with continued rent growth

-

Read the details here

-

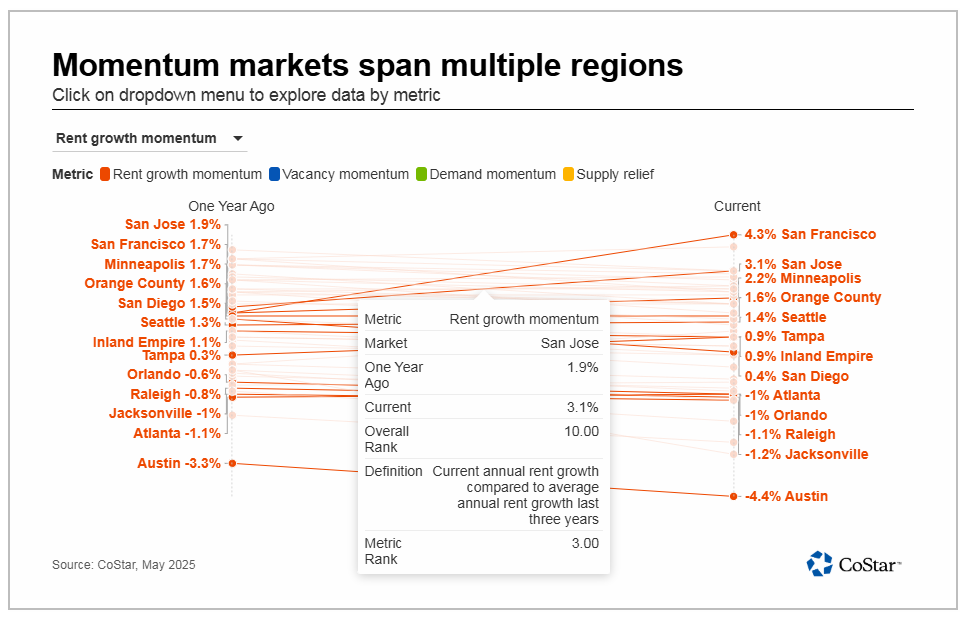

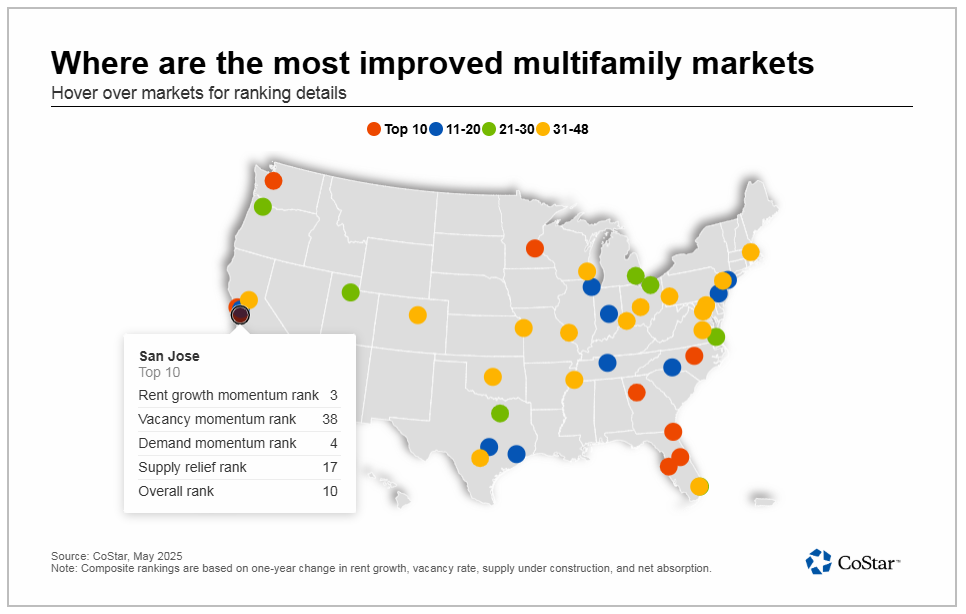

According to CoStar, San Jose now ranks 3rd in rent growth momentum, rising from 1.9% a year ago to 3.1% today

-

Read the full article here

-

According to CoStar, San Jose saw a 2.0% quarter-over-quarter rent growth in Q1 2025

-

Read more here

-

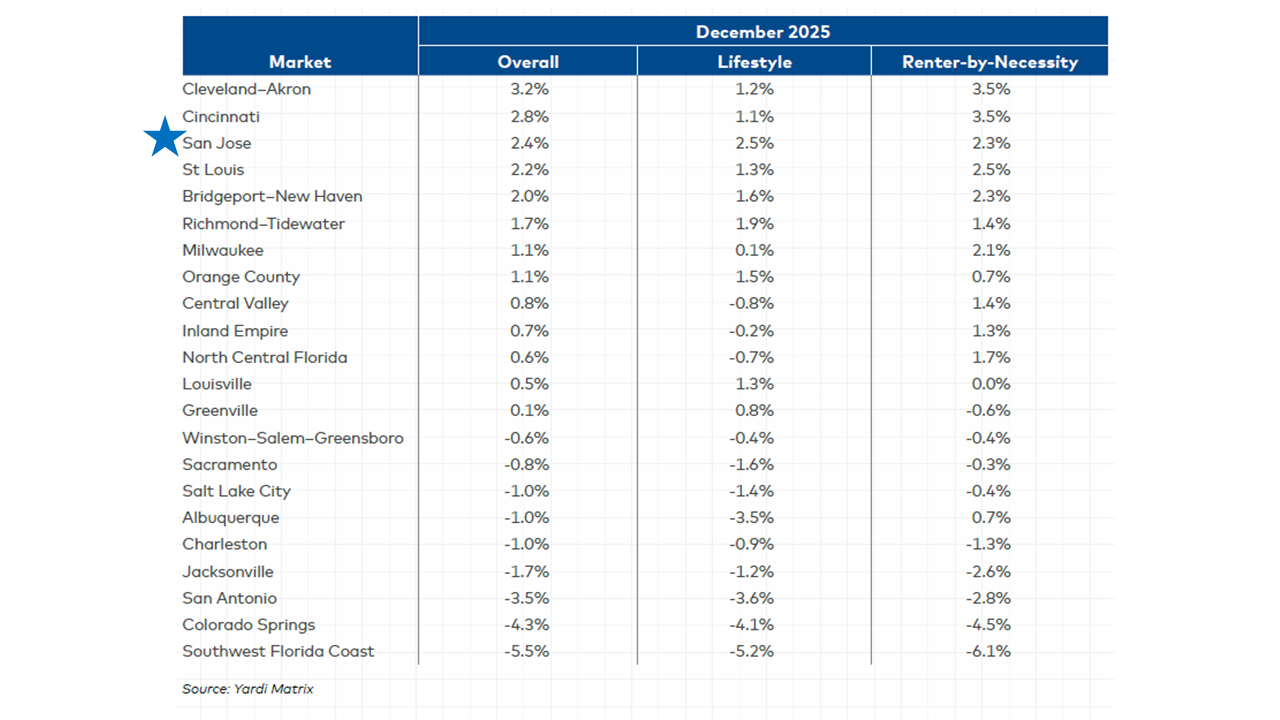

According to Yardi Matrix’s December 2025 report, San Jose posted a 2.4% year-over-year rent growth, one of the highest in the nation

-

Read the full report here

Average home prices in Silicon Valley have exceeded $2 million, contributing to a competitive rental market as potential homeowners turn to renting

-

The San Jose metropolitan area has for years had the highest home values in the United States

-

The area set record high at the end of 2024, with a typical home value of $1.59 million in December 2024

- Values in the San Jose metro area rose by nearly 8%, more than $100,000, from December 2023 — the fastest rate among the 50 largest areas

-

Read the full article here

-

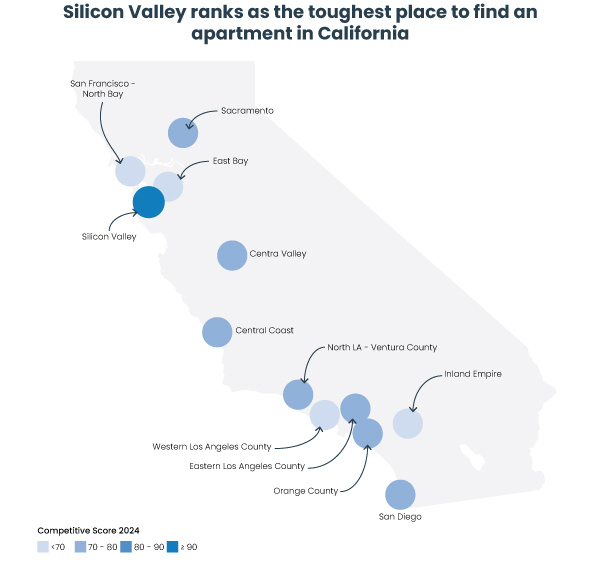

Where’s the toughest place to find an apartment in California? Spoiler Alert, it's Silicon Valley

-

Read the full article here

.png?width=2991&height=762&name=UrbanCatalyst_Horizontal%20Logo_Blue%20w%20Dk%20Blue%20(RGB).png)

.jpg)